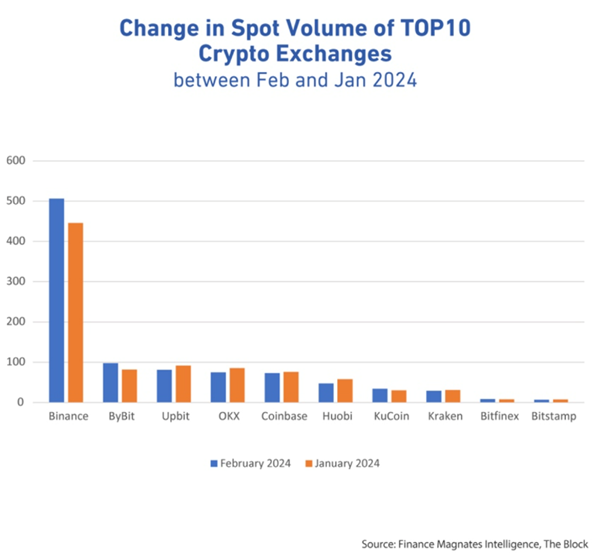

Recent data from Finance Magnates shows a growing dominance of spot trading in the crypto market, with the top ten exchanges reporting $960 billion in spot volumes for February 2024.

The rise in spot trading is partly attributed to advancements in liquidity aggregation, which enhance market efficiency by providing better access to liquidity and more competitive pricing. As a fundamental and increasingly prevalent trading method, crypto spot trading enables traders to buy or sell cryptocurrencies at the current market price for immediate delivery. Its simplicity and straightforward nature make it a favored choice among both novice and seasoned traders. Platforms like CrocoExchange offer a user-friendly environment for engaging in spot trading, with tools that simplify cryptocurrency transactions and portfolio management.

Understanding Crypto Spot Trading

Crypto Spot Trading refers to the buying and selling of cryptocurrencies for immediate settlement. In this method, transactions are executed at the current market price, known as the spot price, and the exchanged assets are transferred to the buyer’s or seller’s account right away. This is the most straightforward form of trading in the cryptocurrency market, where the trader owns the actual digital asset once the transaction is completed.

For instance, a trader wants to buy 1 BTC at its current market price of $60,000. They would place a buy order for 1 BTC, and once the transaction is completed, they would receive the coin in their digital wallet.

Similarly, if a trader wanted to sell their 1 BTC at its current market price of $60,000, they would place a sell order for 1 BTC. Once the transaction is completed, they will receive the equivalent amount in their preferred currency.

In spot trading, the focus is on the actual transfer of ownership and immediate settlement, rather than betting on future price movements or leveraging positions.

Key Characteristics of Crypto Spot Trading

Immediate Settlement

Spot trading involves the immediate exchange of assets. Once a trade is executed, the cryptocurrencies are transferred to the buyer’s wallet or the seller’s account without delay. This contrasts with derivatives trading, where the settlement occurs at a future date.

Actual Ownership

When engaging in spot trading, traders acquire actual ownership of the cryptocurrency. This means they have control over the digital assets and can use them for transactions, hold them as an investment, or transfer them as needed.

Market Price Execution

Trades are executed at the current market price, known as the spot price. This ensures that the transaction reflects the prevailing market conditions, providing transparency and immediacy.

Liquidity Aggregation

Liquidity aggregation plays a vital role in spot trading. It involves combining quotes from multiple liquidity providers to offer the best possible price and execution. This enhances market efficiency by providing access to a larger pool of liquidity, reducing slippage, and ensuring that trades can be executed at competitive prices.

Simplicity

Spot trading is relatively simple compared to other trading methods. Traders buy or sell cryptocurrency directly, without dealing with complex financial instruments or leveraged positions.

How Crypto Spot Trading Differs from Other Trading Methods

Futures Trading involves buying or selling contracts that obligate the trader to purchase or sell a specific amount of cryptocurrency at a predetermined price on a future date. Unlike spot trading, futures trading does not involve the immediate transfer of assets. Instead, it focuses on speculating about future price movements. Futures contracts can be used for hedging or speculation, and they may require margin, which adds leverage to the position. This can amplify both potential gains and losses.

Options Trading gives traders the right, but not the obligation, to buy or sell a cryptocurrency at a specified price within a certain timeframe. Options contracts can be used for hedging or speculative purposes. Unlike spot trading, where the transaction is executed immediately, options trading involves paying a premium for the right to execute the trade later. Options trading provides more flexibility but also introduces additional complexity and potential risk.

Margin Trading involves borrowing funds to trade larger positions than the trader’s initial capital would allow. This form of trading amplifies potential gains but also increases the risk of significant losses. Margin trading can be applied to both spot and derivatives markets, but it introduces leverage, which means traders are using borrowed funds to increase their exposure. In contrast, spot trading does not involve leverage and focuses on the immediate purchase or sale of the asset.

Derivatives Trading involves financial instruments whose value is derived from an underlying asset, such as futures, options, or swaps. These contracts allow traders to speculate on the price movements of cryptocurrencies without owning the actual asset. Derivatives trading can be highly leveraged and complex, involving various strategies and risk management techniques. Spot trading, by contrast, involves straightforward buying and selling of the actual cryptocurrency.

Benefits of Crypto Spot Trading

Transparency

Spot trading provides transparency, as transactions are executed at the current market price. This ensures that trades reflect the prevailing market conditions and offers clarity in pricing.

Immediate Ownership

Traders gain actual ownership of the cryptocurrency, enabling them to use, hold, or transfer the asset as they see fit. This contrasts with futures or options trading, where the actual asset may not be transferred until a future date.

Reduced Complexity

Spot trading is straightforward, making it accessible for both novice and experienced traders. The simplicity of buying or selling the asset directly without additional financial instruments or leverage simplifies the trading process.

Liquidity Access

With liquidity aggregation, traders benefit from access to a larger pool of liquidity, improving execution speed and minimizing slippage. This ensures that trades are executed at competitive prices with minimal impact on the market.

Conclusion

Crypto spot trading is a fundamental trading method in the cryptocurrency market, characterized by the immediate exchange of assets at the current market price. It offers simplicity, transparency, and actual ownership of the cryptocurrency. By leveraging liquidity aggregation, traders can access better prices and execution, enhancing their trading experience. Spot trading differs from other methods, such as futures, options, and margin trading, which involve various levels of speculation, leverage, and complexity. Understanding these differences helps traders choose the most suitable trading method for their needs and objectives.